How to Evaluate Payment Integrity Solutions: The Ultimate Guide for Health Plans

Payment integrity solutions vendors make many claims. Here are the top 14 areas of evaluation to ensure a perfect fit for your health plan.

Virtually every health plan is looking to address shrinking margins by moving their medical savings from a typical 1-2% today to something above 10% (8% avoidance and 2% recoveries) over the next few years. At the same time, the amount of healthcare data is only expanding, making that goal more difficult to address with current solutions. Are you prepared to thrive in this increasingly complex environment? You may find it’s time to evaluate payment integrity vendors and solutions.

Most of the health plans and payers we talk with are in one of two camps: a few self-developed solutions for claims audit and recovery, or scores of piecemeal applications used by the assorted departments dedicated to different areas of cost containment.

No matter your current approach, health plans have an increasing number of advanced technology choices in front of them, all promising “the answer.” New solutions emerge every day to address your interoperability, data and analytics challenges. As your options expand, so do your chances of finding the right fit for your organization – or the wrong one.

What’s at stake? Your rate of recovery.

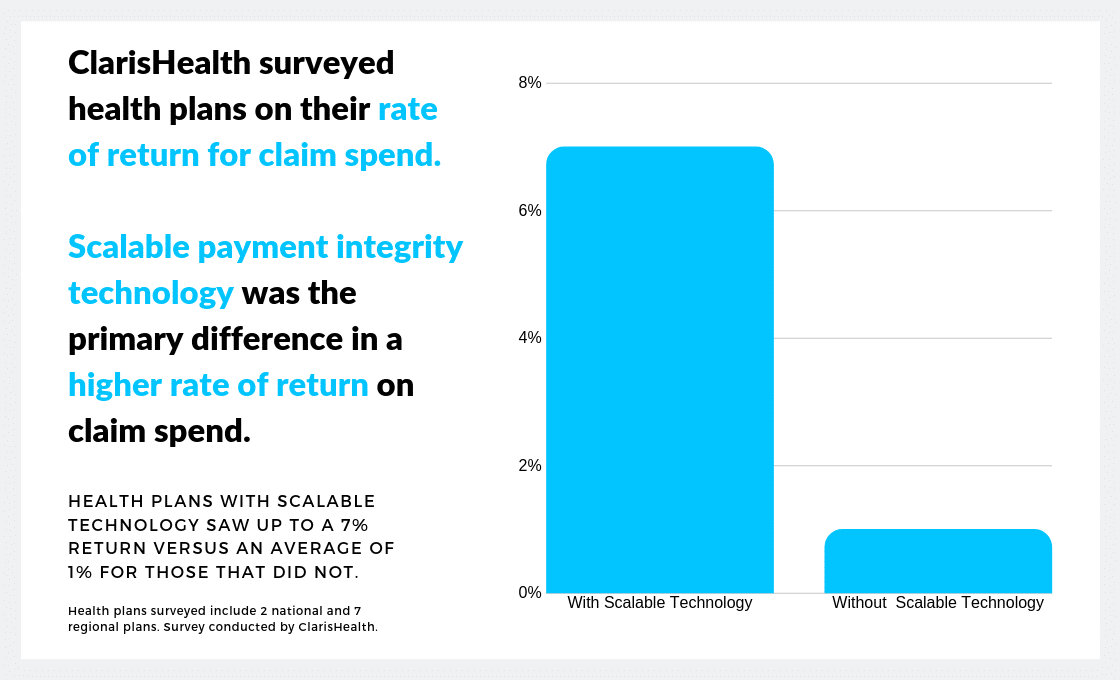

Choosing the right payment integrity solution for your health plan holds arguably the greatest potential impact on your bottom line. When ClarisHealth conducted a survey examining payment integrity returns on claim spend at the leading national and regional health plans, we discovered a key difference. Those payers who had a scalable technology solution in place more than tripled their rate of recovery. Those that depended on outdated applications that require a great deal of manual intervention just couldn’t compete.

As your health plan looks to evaluate payment integrity solutions emerging on the market, three questions will guide you in your search:

- What are the most important elements of functionality to consider to address your needs – now and into the future?

- Is the goal a single, integrative platform to replace manual and piecemeal tools, or an assortment of upgraded solutions?

- How do the different options – payment integrity platforms, self-developed technology, claims editors, fraud tools, third-party services providers – stack up against each other?

In this guide, we will examine the most important areas of consideration to offer a comprehensive payment integrity checklist for your health plan’s needs.

Functionality is the Top Consideration

When you start to evaluate payment integrity options (and consequently, the tech companies and services providers that develop these solutions), functionality should be the top consideration. Nested under functionality are several areas of evaluation that make up a powerful payment integrity checklist:

1. Vendor Management and Optimization

Services vendors are a big part of most cost containment strategies. So, the ideal payment integrity solution should optimize the value you receive from third-party suppliers. Look for functions like overlap control, contract management and performance reporting all integrated through a single platform. Onboarding a new payment integrity supplier should also be quick and easy. With this functionality in place, you should expect to realize, on average, a 35% increase in vendor efficiency.

2. Audit Workflow and Analytics

If you want to internalize more payment accuracy efforts, you should prioritize functionality that assists in maximizing advanced analytics and hit rates. Look for access to insights needed to create internalization strategies around cost optimization in both pre- and post-pay environments. Because workflows differ greatly between payers, ensure configurability in this area to integrate vendor and internal recovery management efforts. Full visibility on auditor throughput and automation to eliminate routine administrative tasks that bog down valuable staff hours are also key. Altogether, this functionality could boost your internal analyst activity 3x.

3. Clinical Workflow and Analytics

Concerns about increasing provider friction keep health plans from taking full advantage of the skilled clinical coders and nurse auditors on staff. The ability to coordinate seamlessly between vendors and internal resources on provider outreach to prevent overlap, internalize the best analytics from all sources, and fully reconcile each audit removes that limitation. In addition, look for A.I.-powered solutions that unlock unstructured text in the medical record to prioritize claims for review. This advanced functionality could decrease your medical expenditures by 2-4% and reduce the chance of errors.

4. Prepay Workflow and Analytics

With as few as 15 days to make a pay/deny decision on a claim, many health plans choose to “pay and chase.” But with time and quality improvements, health plans can move more audit work prepay. Seamless integrations with data sources, post-pay and service vendors will allow for comprehensive audit management. As will automated workflows and clear visibility into timelines and hit rates. Also look for the ability to extend the most successful post-pay concepts to prepay and take advantage of multiple detection sources. With comprehensive payment integrity technology in place, your health plan can put greater focus on internal prepay avoidance, and a 10% improvement is common.

5. Anti-FWA

Relying solely on fragmented case and allegation management tools for anti-FWA efforts that silo data unnecessarily stifle the effectiveness of SIU teams. Consider a comprehensive solution that bridges the audit and investigation divisions of your health plan while maximizing efficiencies with case tracking, investigations, and federal and state reporting.

Annual spending on artificial intelligence in healthcare estimated to reach be more than $34 billion in 2025. A recent survey of healthcare organizations found 98% have implemented an A.I. strategy or plan to develop one. And 59% of healthcare leaders expect to achieve a full return on their investment within three years. “Will Artificial Intelligence Finally Make Good on Its Promise to Healthcare?”

6. Reporting and Business Intelligence

Actionable business intelligence allows health plans to drive maximum efficiency and effectiveness. Seek out real-time metrics that can be leveraged for accurate reporting on-demand and configurable role-based dashboards to scale business intelligence solutions system-wide.

7. Provider Engagement

Your payment integrity processes have the potential to damage or improve the payer-provider relationship. Features like electronic overpayment notifications, engagement tools, underpayment management and provider self-reporting can streamline your operations, improve provider relations and reduce costs for both parties.

If this functionality checklist covers more than what your health plan currently needs, that’s exactly the point. You should evaluate payment integrity advanced technology based on its ability to scale. It should grow as you grow. That doesn’t mean you have to take on all areas of functionality at once; a modular approach to implementation brings many benefits to health plans.

Get the Checklist

This evaluation criteria is available as a handy download so you can be confident in your payment integrity solution choice.

Additional Considerations to Evaluate Payment Integrity Solutions

A search for enterprise payment integrity technology doesn’t stop at functionality questions, particularly as a health plan evaluates various solutions and/or a more comprehensive platform. The feature set alone will not paint the whole picture. To ensure a technology solution meets your needs today and into the future – and fits within the budget – we recommend you look a little deeper.

After evaluating payment integrity vendors based on functionality, the following areas should also be reviewed:

1. Flexibility

Not all payment integrity solutions offer flexibility, which is why some health plans choose to build their own solution. That path, while offering full customization, also comes with some inherent challenges. Read an analysis on the build vs. buy argument here. Flexible, configurable off-the-shelf solutions (COTS) can mitigate the need for a custom build. While taking advantage of best practices inherent in industry standard solutions.

2. Total Cost of Ownership

Factor in maintenance, annual licensing and setup costs. Also consider how much investment and effort it will take to improve the technology and its adoption. Combined with any potential financial improvements, how will ROI be impacted?

3. Integration and Ease of System Implementation

What training and support does the solution provider in question offer? How often do they update their platform, and how well will it integrate with current and future suppliers and providers? Weigh your needs for integrations that can be supported by SFTP vs. API connections. Integrated data flows can help health plans build a scalable technology stack.

Total payment integrity platforms turn projects that would usually require dozens of integrations into straightforward one-time connections. Integrating accounting platforms, CRMs, service vendor systems, provider systems, claims editors and more with a payment integrity platform provides unique synergies without overtaxing IT. “Why Health Plans Should Choose a Scalable Technology Platform?”

4. User Friendliness

How intuitive is the technology’s user interface and user experience? Evaluate this aspect from the end user perspective as well as managers and decision-makers. Also consider that cloud-based solutions will differ from on-premise in terms of stakeholder engagement, efficiencies and data accessibility. The healthcare industry is increasingly moving all electronic systems to “the cloud” to reduce capital investments in quickly obsolete hardware.

5. Security

Health plans are rightly concerned about data privacy and security. Your technology vendor should have protocols in place to mitigate these concerns. How easy is it to control users’ access and permissions? Look for technologies that allow for controlling access and permissions at object/table-level, at feature-level, and at field-level as well as an audit trail to track changes. Features like single-sign-on, two-factor-authentication, and the ability to insist on password requirements are also ideal.

6. Working with the Technology Vendor

Whether your health plan decides to build its own solution, buy one or subscribe to one, you will be working with this group for years to come. How responsive, reliable and overall customer-oriented are they?

How Does Enterprise Payment Integrity Technology Stack Up Against Other Solutions?

When we speak with health plans and payers, we find that there’s some confusion surrounding the elements of a robust payment integrity program. Often, they see a claims editor or a FWA tool as a complete payment integrity solution. These tools offer great value but are limited in scope. We regularly uncover gaps and hidden revenue for plans that rely solely on these siloed approaches.

However, an enterprise payment accuracy platform should seamlessly integrate with these tools to prevent further gaps. Pareo was created to connect external solutions, data streams and third-party services vendors. We recommend you set your benchmark at total payment integrity. But you can use this checklist to evaluate other elements of a payment integrity program.

How to evaluate payment integrity solutions compared to Pareo

Self-developed technology: Self-built payment integrity solutions incur large, ongoing costs for health plans. A self-built solution will require a longer lead time before you can realize ROI. Additional considerations for those considering building an in-house solution are functions that need to be included, expertise, and needed integrations. Pareo can be implemented quickly and offers many immediate benefits to a health plan.

Claims editors: Pareo works in tandem with claims editing solutions by improving their scope and automating much of the workflow.

Fraud tools: FWA solutions, like claims editing solutions, are limited in scope and therefore not comprehensive. They should not be a health plan’s only line of defense in preventing improper payments. If you already use a rules-based tool, you can integrate its data into Pareo.

Third-party services vendors: A health plan considering third-party vendors doesn’t have to choose between Pareo and their business partners’ solutions. Pareo offers supplier optimization tools that allow for platform integration, improving a payment integrity program’s performance and workflow.

Now’s the time for total payment integrity

See the ClarisHealth 360-degree solution for total payment integrity in action.