Should You Build Your Own Supplier Management Solution?

Take our quiz to help you decide if build or buy is right for your health plan.

By now, you likely realize that your health plan needs a way to manage the many third-party vendors that allow you to maximize recoveries and optimize costs. The question is, should you build a solution internally or buy one?

We routinely run across health plan stakeholders in the midst of customizing their claims editor and other resource-intensive but relatively manageable IT projects. Most recently, we encountered a health plan considering building their own vendor management solution. That they need a solution is understandable. That they plan to build it themselves begs the question, “Are you a health insurance provider or a technology company?”

You know building your own software is going to cost more than you budgeted for, your IT resources are already constrained, and your expertise may be limited. But if your needs are truly unique, why look for a flexible, robust technology solution created with the support of industry-wide insight when you could devote millions of dollars to a solution of your very own?

In all seriousness, building a software solution with the ability to plug into dozens of independently-operated platforms (as in the case of third-party vendors) requires some heavy lifting. Are you ready? Let’s find out!

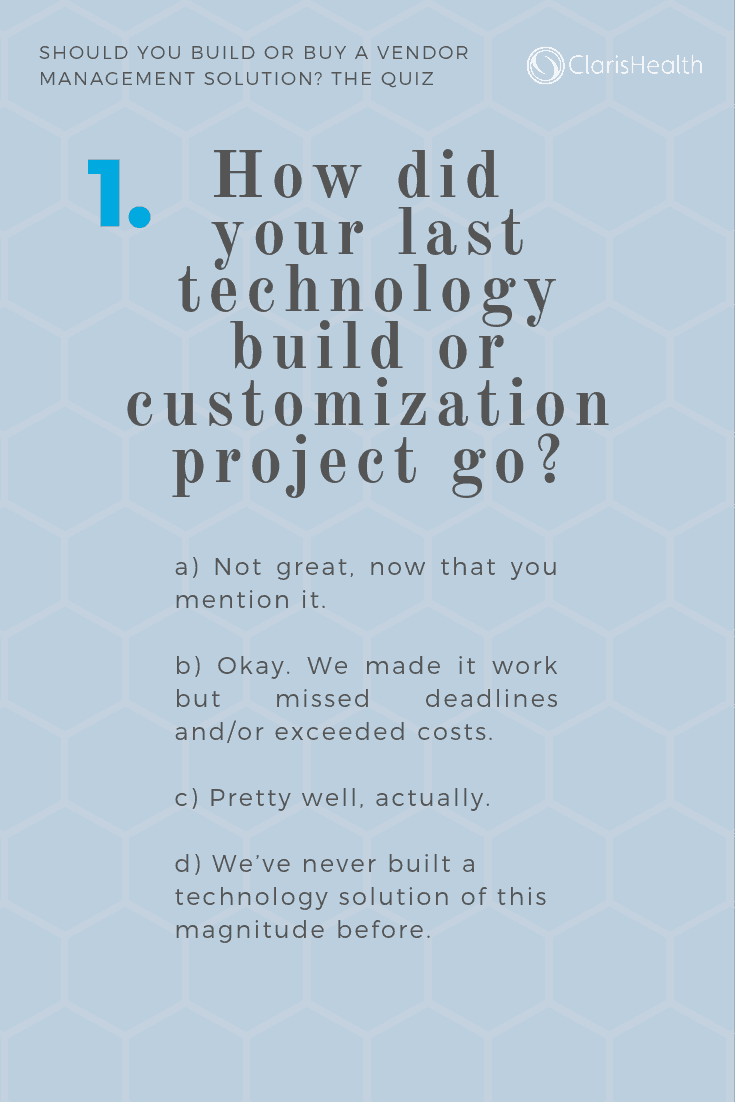

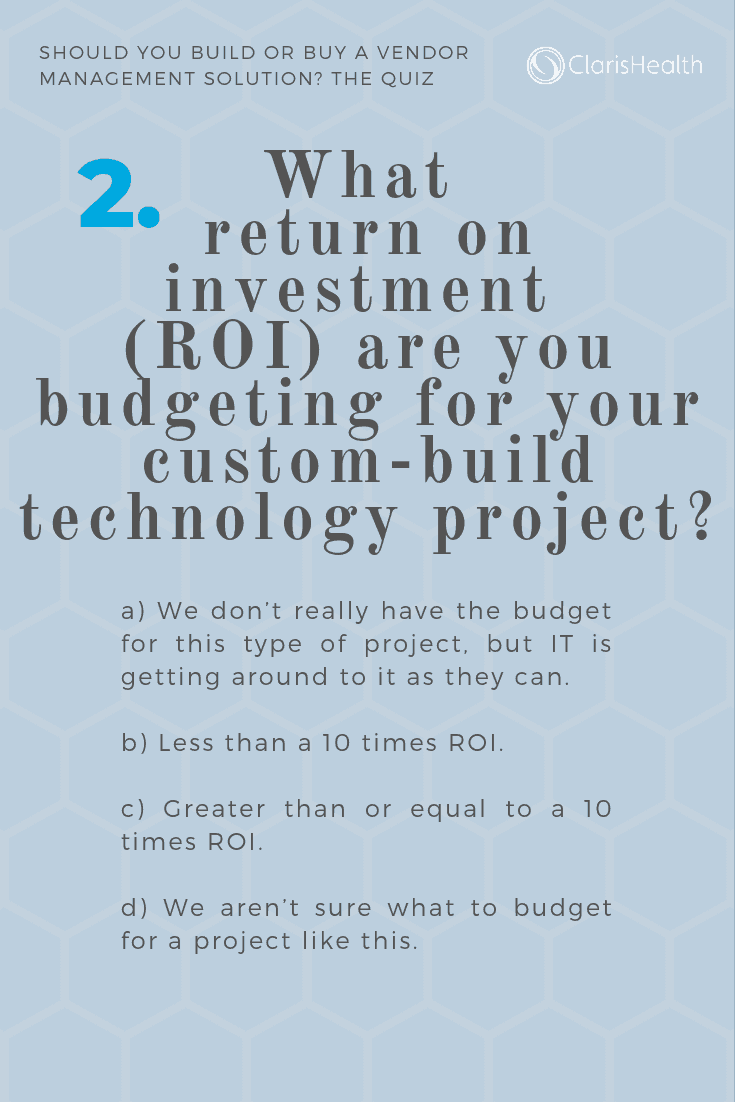

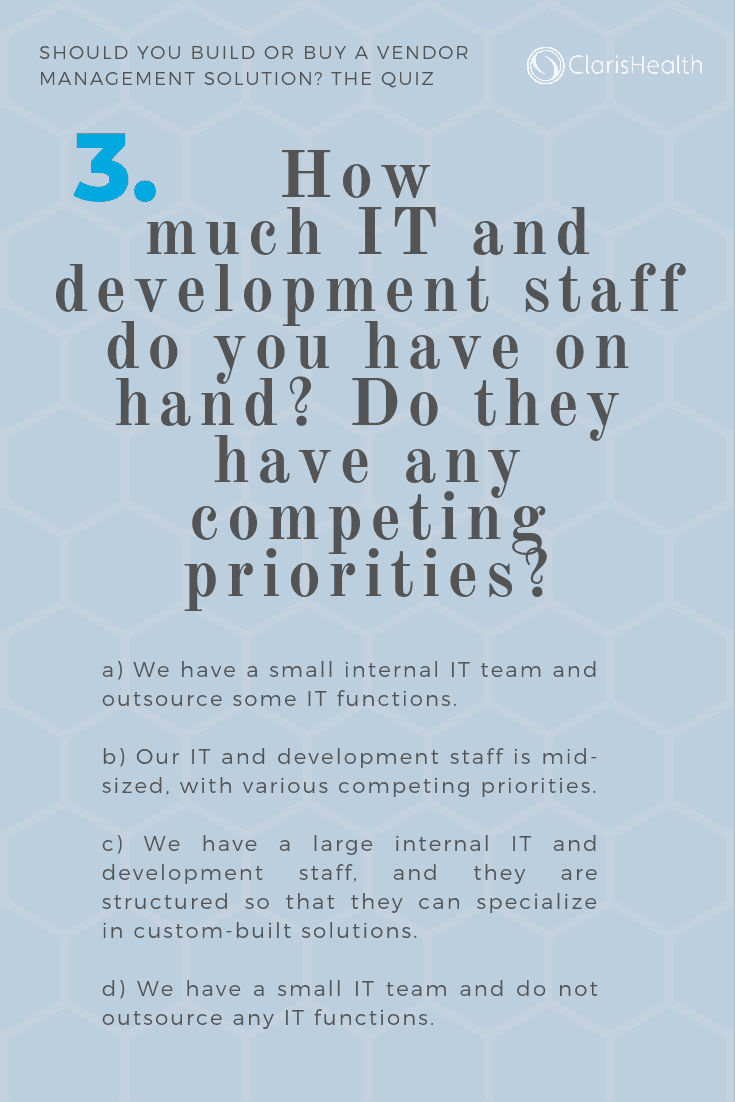

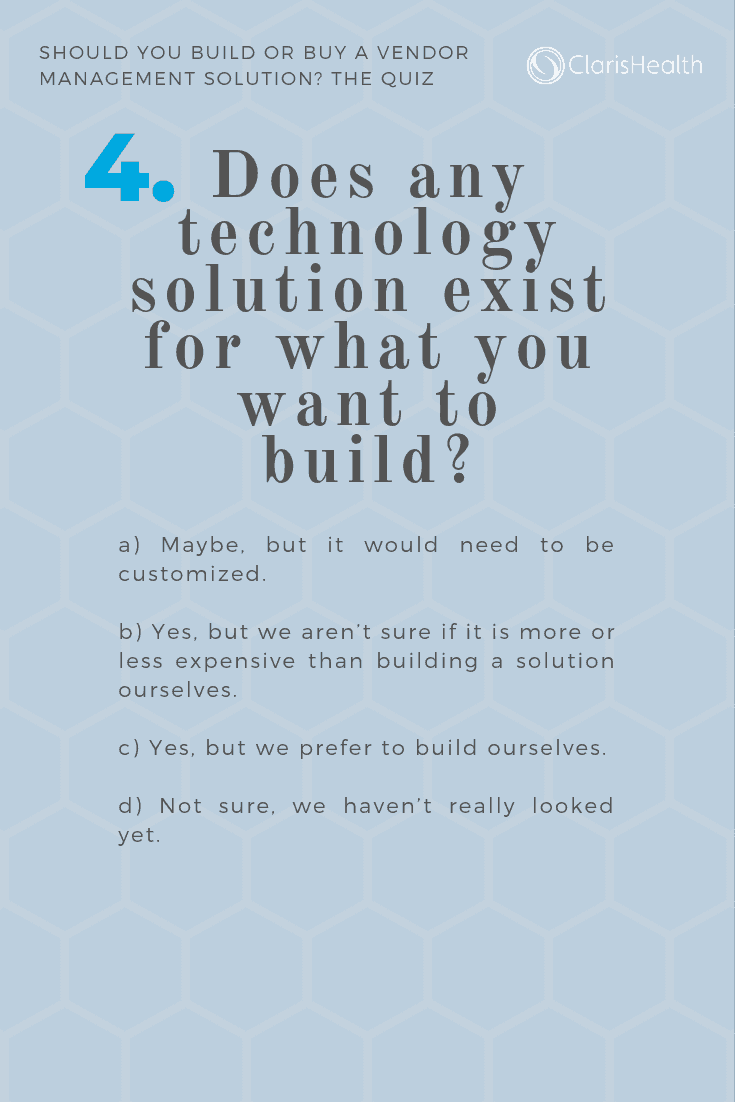

Should You Build or Buy a Vendor Management Solution? The Quiz

To take this quiz, view the following slideshow and record your answers.

Results

Perhaps you’ve already tried to build your own IT solution, and it didn’t go anywhere. Or maybe you’re on the fence about building something that’s already on the market. However, you aren’t sure if what’s out there is really what you need. Not all vendor management solutions are the same, and we’ve learned that our clients appreciate the customization opportunities that Pareo® offers. In fact, we offer the ability for health insurance providers to completely outsource vendor management to us.

Because you’ve likely tried to build a software solution before, you may face internal pressure to just “make it work.” Here’s a helpful guide that discusses what it takes to successfully develop software (hint: It’s not simple). Borrow a page from tech company playbooks and take a realistic approach to any internal software development efforts.

You may – or may not – be able to successfully build your own vendor management solution. But it’s important to ask if IT development is really your true calling. Most health insurance providers we speak with develop internal software solutions as a means to an end. They quickly realize that the upkeep and maintenance associated with these insular solutions is not manageable. That’s because building an internal IT solution isn’t the same as buying one from a company whose sole focus is solving the types of challenges your health insurance company faces.

“Technology alone delivers no value. It’s the combination of a clear strategy, the right technology, high-quality data, appropriate skills, and lean processes that adds up to create value. Any weak link in this chain will lead to poor value delivery from IT,” writes McKinsey. As you evaluate whether or not to build or buy your own vendor management solution, consider all the elements at play. Technology alone isn’t enough; to be successful, you’ll need a force behind your internal IT development.

You are the healthcare insurance unicorn – an IT-heavy, resource-laden organization that really can build your own internal software. We would ask you though, why reinvent the wheel? If a great vendor management solution does exist, and can be customized, why not tackle a software development project for which there isn’t already an answer?

“Building custom software can unlock a host of benefits, but companies should only pursue that strategy if a) better software can provide a competitive advantage relative to your competitors, and b) you are building a large business that can spread the cost of a proprietary system over a large number of clients,” writes one Forbes contributor with experience on the matter.

Taking on a software development project like this may derail your small IT resources, who would be better focused on their core competencies. We suggest exploring solutions that are already built and extremely customizable, like Pareo®. Not only do we offer the technology you need to manage multiple third-party vendors, but we also walk small health insurance plans through the steps of payment integrity program creation. Still sound like a little more than you’re ready for? Consider completely outsourcing vendor management.

By outsourcing vendor management, you can quickly implement a successful payment integrity program that your IT department can plug into. Consider what qualifies as “good” when it comes to vendor management: “Good vendor management allows your organization to build a successful and stronger relationship with your suppliers or service providers.” Can you really do that if your time, attention and money are caught up in developing software to manage vendors?

Final Thoughts

In an age where customer-centric technology projects are increasingly consuming the insurance industry, building a supplier management solution yourself may just be a waste of time. We developed Pareo® to specifically address the concerns of this industry: Function, Flexibility, ROI.

In fact, it’s not uncommon for Pareo® clients to see a 10x return on their investment. Read our latest case study to learn more.

Now’s the time for total payment integrity

See the ClarisHealth 360-degree solution for total payment integrity in action.